For many individuals, the answer is increasingly ‘no’. Yahoo and the Wall Street Journal report that:

Fifty-seven percent of U.S. workers surveyed reported less than $25,000 in total household savings and investments excluding their homes, according to a report to be released Tuesday by the Employee Benefit Research Institute. Only 49% reported having so little money saved in 2008.

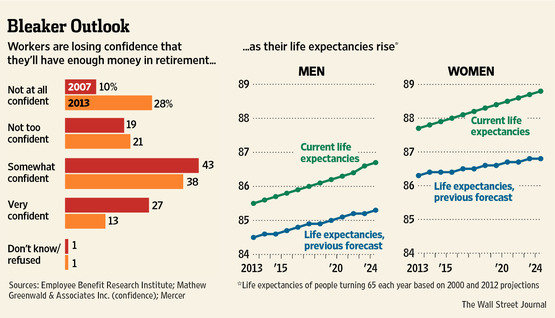

As the graphic below shows, more and more people do not believe they have enough money saved for retirement.

In the past, workers could count on employers defined benefit plans to provide them with security in retirement. This is no longer the case. “The portion of private-sector U.S. workers covered only by so-called defined-benefit plans fell to 3% in 2011 from 28% in 1979, according to U.S. Department of Labor data compiled by EBRI.”

As a healthcare leader and a part time financial counselor, I see the primary problem is the overall change in our culture. Consumption first has taken over save first over the past 20 years. Boomers are now panicked and realize that their lifestyles, use of credit, and general unawareness to their finances have placed them in a position of realizing they do have enough to retire comfortably.